Credit insurance by Cheyenne is a type of insurance that provides coverage for businesses or individuals in the event that a borrower defaults on a loan or credit agreement. It is designed to protect lenders or creditors from financial loss in the event that a borrower is unable to repay a loan or credit. It is not specific to the city of Cheyenne, Wyoming and it is available in many places.

You may also like

Types of credit insurance buy Cheyenne

There are several different types of credit insurance that are available. Some examples include:

- Account receivable insurance: This type of insurance provides coverage for businesses in the event that a customer or client defaults on a loan or credit agreement.

- Mortgage credit insurance: This type of insurance is designed to protect lenders in the event that a borrower defaults on a mortgage loan.

- Personal credit insurance: This type of insurance is designed to protect individuals in the event that they are unable to make payments on a personal loan or credit card.

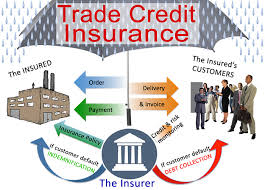

- Trade credit insurance: This type of insurance is designed to protect businesses from financial loss due to non-payment by a customer or supplier.

It is important to note that the availability of these products may vary depending on the location and the insurance company. It is not specific to the city of Cheyenne, Wyoming.

Cost of credit insurance buy Cheyenne

The cost of credit insurance can vary depending on a number of factors, such as the type of credit insurance, the amount of coverage, and the creditworthiness of the borrower. Generally, the cost of credit insurance is based on a percentage of the total loan or credit amount. The rate can be as low as 0.25% to as high as 5% of the credit amount, but it can be higher for higher-risk borrowers.

It’s important to note that the cost of credit insurance can vary depending on the company and location. It’s also important to shop around and compare different policies and prices from different insurance providers. In Cheyenne, WY, the cost of credit insurance may be different from other places, based on the local market conditions and the availability of providers.

It’s also important to keep in mind that credit insurance is not always necessary and the cost of the insurance should be weighed against the potential benefits. It’s important to evaluate your risk and the need for credit insurance before making a decision.

Benefits of credit insurance buy Cheyenne

Credit insurance can provide a number of benefits, including:

- Protection against non-payment: Credit insurance can protect your business against the financial losses that may occur if a customer fails to pay their invoice.

- Credit risk management: With credit insurance, you can manage your credit risk more effectively by identifying and mitigating potential issues before they become major problems.

- Improved cash flow: Credit insurance can help to improve your cash flow by reducing the amount of money you need to set aside to cover potential bad debts.

- Increased access to credit: With credit insurance, you may be able to access more credit from lenders and suppliers, as they will be more willing to do business with you if they know you are protected against potential losses.

- Peace of mind: Credit insurance can give you peace of mind knowing that you are protected against the potential financial losses that can result from a customer’s non-payment.

It’s important to note that credit insurance is not available in all states, and the availability and terms of coverage may vary depending on location.

How To apply for credit insurance buy Cheyenne

Applying for credit insurance typically involves the following steps:

- Research different credit insurance providers: Look for companies that offer credit insurance in your state and compare their coverage options and prices.

- Determine the type of coverage you need: Consider what type of credit insurance you need, such as single-buyer coverage or portfolio coverage.

- Gather the necessary information: You will need to provide information about your business, such as your financial statements, credit history, and customer list.

- Complete the application: Fill out the application provided by the insurance company, being sure to provide all the required information.

- Submit the application: Once the application is complete, submit it to the insurance company for review.

- Wait for approval: The insurance company will review your application and determine whether you are approved for credit insurance.

- Purchase the policy: If you are approved, you will need to purchase the policy and pay any necessary premiums.

It’s important to note that the process of applying for credit insurance can vary depending on the insurance company and the type of coverage you are seeking. It’s always best to check with the company to see what their specific requirements are.

Leave a Comment